Car Allowance Taxable in Malaysia

There are a few things we need to consider. Tax exempt up to RM 6000 per year only if used for official duties.

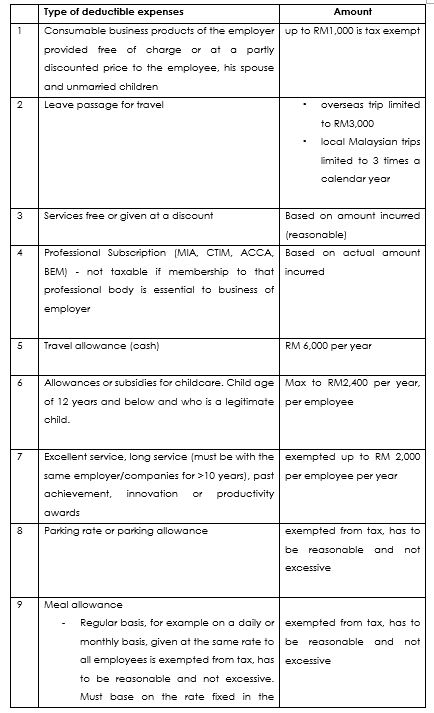

List Of Tax Deduction For Businesses Cheng Co Group

In this article applicants will be subject to a review of 3 types of allowances with reference to the Tax Ruling of the Inland Revenue Board of Malaysia LHDN.

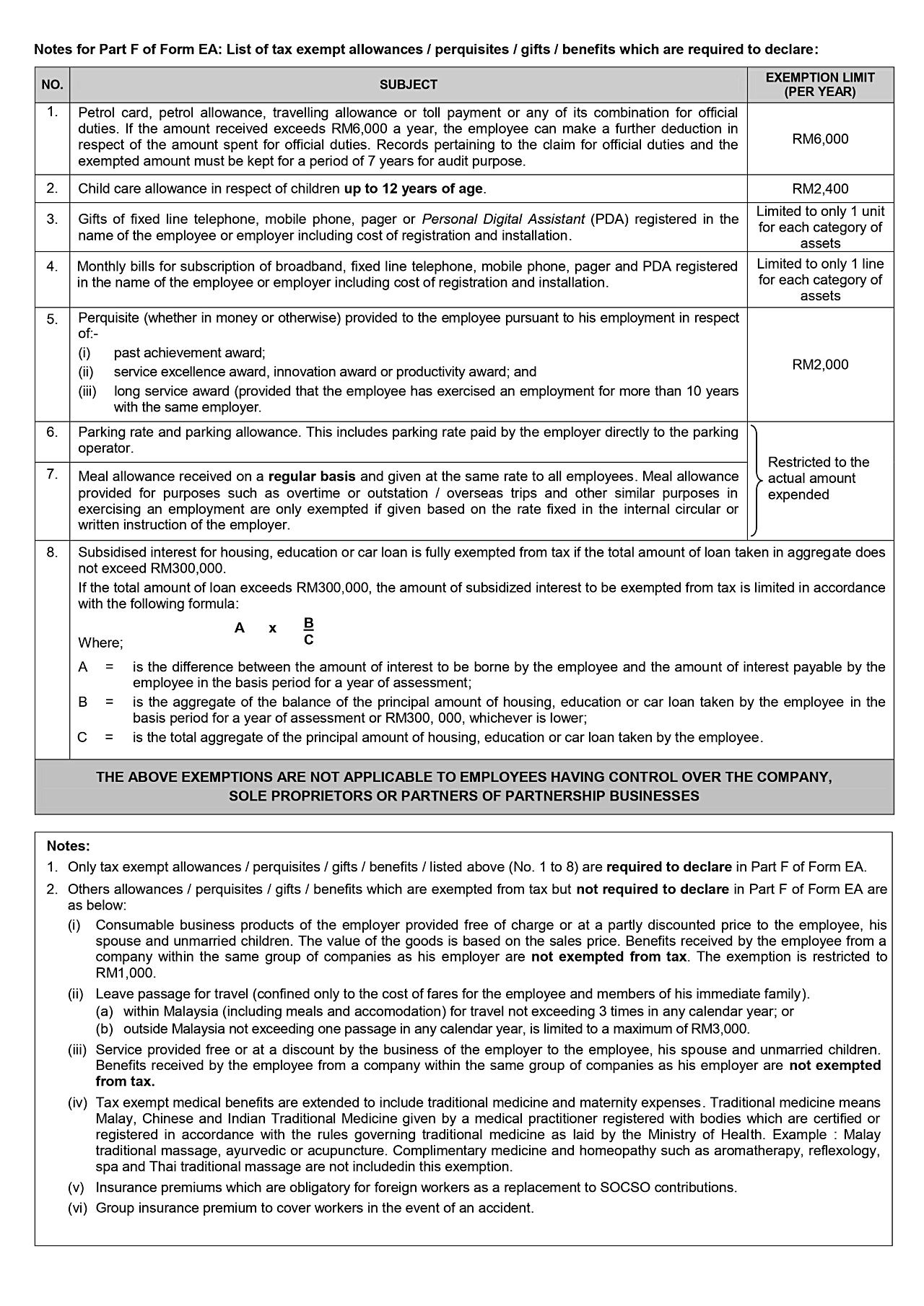

. Exemption available up to RM2400 per annum Parking fees allowances. However there are exemptions. More than RM 6000 may be claimed if records are kept for 7 years.

Petrol allowance petrol card travelling allowance or toll payment or any combination. Only applicable for YA 2009 to 2010 Travelling allowance petrol cards petrol allowance or toll. For details about import duties and local taxes from the.

Income Tax Act 1967 Schedule 3 stated clearly that the maximum qualifying expenditure for a private vehicle not licensed on a commercial basis is RM50000 RM100000 if the purchased vehicle is a new vehicle and its value is less than RM150000 this is why everybody believe. 20 of the QPE incurred. For the reference of exempt quotas here is the list of elements and conditions.

Weve listed the most common tax implications below depending on which car allowance method your company uses. Domestic private or capital expenditure The Company can claim capital allowance for capital expenditure incurred Lease rentals for passenger cars exceeding RM50000 or RM100000 per car the latter amount being applicable to vehicles costing RM150000 or less which have not been used prior to the rental. Section 131a Allowances Fixed allowance are taxable income except for the following- Exempted allowance From YA 2009 a travel allowance of RM2400 per year would be exempted for travelling between home and work.

In the US the car allowance tax can significantly reduce the amount your employee gets to cover their vehicle expenses even by 30-40. These rates can be quite high and excise duties can be up to 100 percent when importing a foreign vehicle. Travelling allowance petrol allowance toll rate up to RM6000 annually Parking allowance Meal allowance Child care allowance of up to RM2400 annually Subsidies on interest for housing education car loans.

Royalties collected in connection with the use of copyrightpatents are taxable if they exceed the following exemption limits. Just like Benefits-in-Kind Perquisites are taxable from employment income. In this article applicants will share a review of 3 types of allowances related to the Inland Revenue Board of Malaysia LHDN tax ruling and how deductions affect tax payment.

Total amount paid by employer. Child care allowance for children up to 12 years of age. Subsidised interest for housing education or car loan is fully exempted from tax if the total amount of loan taken in aggregate does not exceed RM300000.

Increment and Reduction in income tax. If the total amount of loan exceeds RM300000 the amount of subsidized interest to be exempted from tax is limited in accordance with the following formula. Fixed car allowance is taxable income at both the state and federal levels.

Under the Rules QPE refers to a capital expenditure incurred under paragraph 2 of Schedule 3 to the Income Tax Act 1965 ITA in relation to provision of machinery and equipment including ICT Equipment except motor vehicle. 40 of the QPE incurred. If the total amount of loan exceeds RM300000 the amount of subsidized interest to be exempted from tax is limited in accordance with the following formula.

Subsidised interest for housing education or car loan is fully exempted from tax if the total amount of loan taken in aggregate does not exceed RM300000. Tax exempt up to RM 2400 per year. Fully exempted Meal allowances.

Exemption available up to RM6000 per annum if the allowancesperquisites are for official duties Childcare subsidies allowances. It is a fixed amount paid for employees vehicle. Travel allowances of up to RM6000 for petrol and tolls are granted tax-free if the vehicle used is not owned by the company.

Total amount paid by employer. Petrol card petrol or travel allowances and toll rates. Import duty must be paid on any vehicles imported into Malaysia.

Company Car Benefit Should I Declare It On My Income Tax Filing

What Type Of Income Can Be Exempted From Income Tax In Malaysia

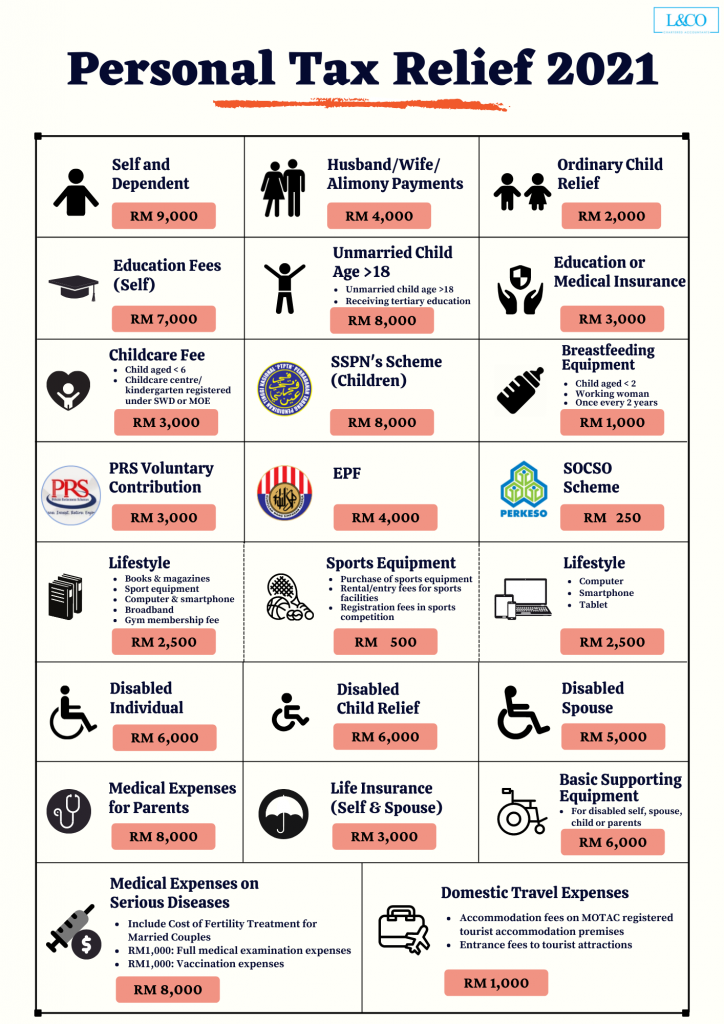

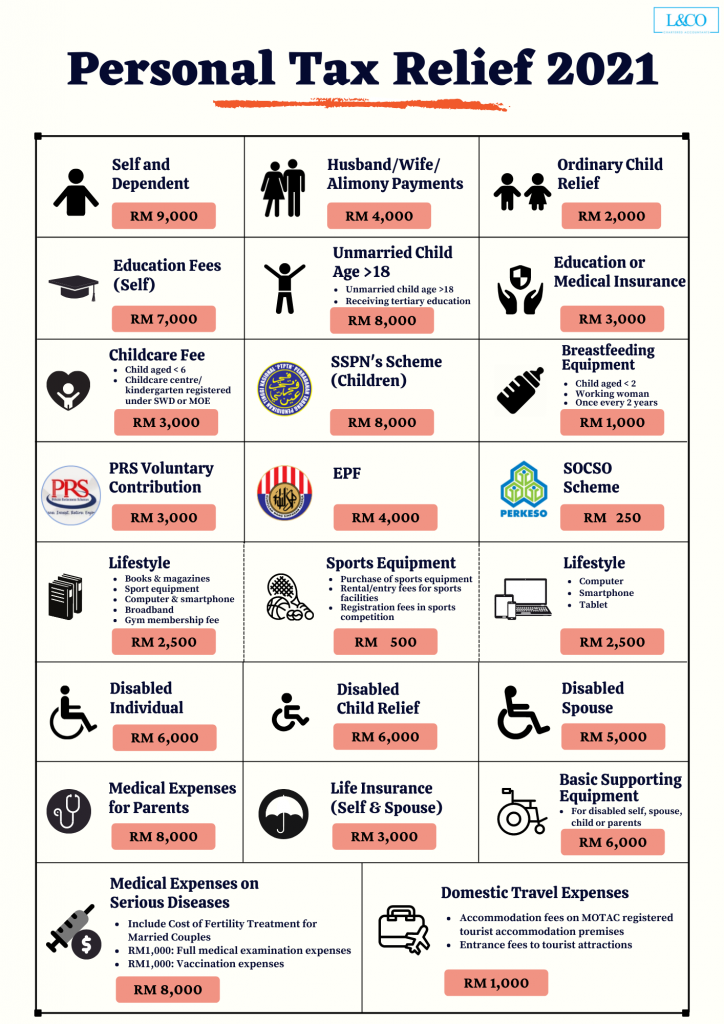

Personal Tax Relief 2021 L Co Accountants

List Of Tax Deduction For Businesses Cheng Co Group

Allowance Guide In Malaysia 2021 Summary Of Lhdn Tax Ruling Seekers

Allowance Guide In Malaysia 2021 Summary Of Lhdn Tax Ruling Seekers

0 Response to "Car Allowance Taxable in Malaysia"

Post a Comment